With advancing technology across every link of the industrial chain and a simultaneous drive for cost efficiency, the industry is witnessing a pronounced shift towards larger-scale, high-capacity N-type products. This trend unmistakably marks a significant stride into the realm of N-type 7.0 era in the photovoltaic sector. As per TrendForce’s statistics, the first half of the current year has seen a cumulative shipments of 150GW in 210mm modules, with Trina Solar alone contributing over 75GW to this figure. Projections indicate that by 2023, the production capacity of 210mm modules is poised to scale up to a remarkable 722GW, constituting an impressive 69.83% of the total capacity. Current data underscores that modules characterized by large sizes and high power have emerged as the central attraction in bidding processes, particularly among state-owned enterprises. High-power modules command a staggering majority, surpassing 98%. A breakthrough has also been achieved in the power output of the 210mm N-type module, exceeding the 700W threshold. This surge in shipments and an explosion in bidding volumes provide compelling evidence that the ascendancy of large-scale, high-power modules is hastening the substantiation of the entire value chain. This trend has garnered resounding global recognition, firmly validated by an array of discerning customers worldwide.

The industry’s primary spotlight has shifted to larger wafers. A remarkable 89.3% surge in the production capacity of 210mm wafers has occurred, with modules constituting a substantial 70% of the overall output.

Regarding wafers, the year 2023 will witness an accelerated thrust toward the evolution of larger and thinner wafers. Capitalizing on their substantial cost-cutting and efficiency-boosting benefits, the market share of these sizable wafers has experienced rapid expansion. According to TrendForce, the production capacity of large wafers is projected to escalate to 878.6GW by 2023, capturing an impressive 95.33% of the market share. Notably, the production capacity of 210mm wafers is set to soar to 357.2GW, marking an impressive 89.3% surge compared to the figures from 2022. Moreover, there is a strong indication of further market share growth in the future.

Percentage distribution of wafer production capacity across various sizes from 2021 to 2026 (Unit: %)

In the realm of cells, the rapid expansion of PERC capacity and the swifter output of N-type cell capacity have hastened the introduction of larger-sized cells into the market. According to TrendForce’s insightful projections, the year 2023 is poised to witness an impressive surge in the production capacity of these sizable cells, reaching a staggering 1136.2GW. This accounts for an overwhelming 96.93% of the total capacity, with 210mm cells making up a significant share. Specifically, the production capacity of 210mm cells is estimated to scale up to 899.9GW, marking a remarkable 179% increase compared to the previous year’s figures. This substantial growth comes alongside a notable market share of 76.8%. The merits of these larger cells have been wholeheartedly acknowledged by both downstream customers and the market as a whole, translating into robust demand.

Production capacity trend of larger-sized cells (manufactured by the equipment), Unit: %

In the realm of modules, according to TrendForce’s projections, the production capacity of expansive components is anticipated to surge to 961GW in 2023, capturing a substantial market share of approximately 92.84%. Notably, within this category, the production capacity of 210mm modules is predicted to achieve a remarkable milestone of 722GW, exhibiting an impressive 116% growth compared to the previous year’s metrics and accounting for 69.83% of the market share. Furthermore, the upward trajectory of production capacity for these larger modules remains consistent, solidifying their increasingly pivotal role within the market landscape.

Evolving market share trends of varying module sizes from 2022 to 2027 (calculated based on equipment compatibility; Unit: %)

The bidding capacity of high-power and large-size modules has surged to encompass over 90% of the total capacity, while the penetration rate of N-type modules is increasing faster.

A testament to the cost-effectiveness and heightened efficiency can be attributed to their increased application scenarios, growing market demand, and technological strides. These modules have swiftly emerged as the preferred mainstream choice within the customer market. Based on a subset of TrendForce’s statistical data, the cumulative bidding capacity for domestic PV modules during the period spanning January to July 2023 has soared to 137.78GW. Remarkably, modules with power outputs surpassing 540W accounted for a substantial 135.5GW, constituting an impressive 98.37% of the total bidding capacity. Similarly, the bidding capacity for large-size modules (measuring 182mm or 210mm) amounted to 135.6GW, capturing 98.42% of the total. Additionally, the bidding capacity for N-type modules reached 25.9GW, accounting for 18.8% of the total bidding capacity. This proportion is on a continuous upward trajectory. Assessing the bidding trend, it’s clear that the market's appetite for high-power and large-size modules remains robust, establishing these modules with an unequivocal dominance within the domestic bidding arena.

Proportional distribution of module bidding capacity across different sizes (Unit: %)

The demand for large-size modules is surging, with 210mm modules having cumulatively shipped a substantial 150GW.

As per TrendForce’s findings, during the first half of 2023, seven prominent module companies collectively dispatched shipments ranging from 144GW to 146GW. Notably, Jinko Solar, Trina Solar, LONGi, and JA all marked shipments exceeding 25GW individually. Over this same period, the collective shipment of 210mm modules, including the 210R, amounted to approximately 150GW. Furthermore, the semi-annual report from Trina Solar reveals that its shipments of 210mm modules had surpassed an impressive 75GW by the end of June 2023. This data underscores the predominant shift toward large-size modules as the market’s primary preference. As the second half of the year ushers in the peak season for installations, the demand for modules is set to surge even further. TrendForce projects that fueled by a blend of cost optimization and efficiency augmentation, the shipments of large-size modules will persistently ascend throughout 2023, accounting for a share exceeding 85%. Moreover, the shipment volume of 210mm modules is poised to achieve new record highs.

Shipments by major module enterprises in 2022 and 2023 (Unit: GW)

Pioneering enterprises have unveiled a series of groundbreaking N-type products, with 210mm+ N-type taking the industry by storm with power surpassing the 700W threshold.

Driven by the continuous evolution of N-type technology and the simultaneous expansion of production capacity, the industrialization of N-type products has been dramatically expedited. This acceleration is underscored by several significant factors. Firstly, N-type module offerings span a diverse range of versions, catering to a spectrum of application scenarios including residential, industrial, commercial distributed, and ground-based power stations. This multifaceted versatility has ignited robust market demand. In response, numerous leading enterprises have rapidly intensified their efforts in the development of N-type products. A comprehensive review of the SNEC exhibition reveals a remarkable shift: more than two-thirds of participating enterprises have prominently featured their N-type product offerings, solidifying these products as the dominant trajectory within the market.

Simultaneously, the production capacity of N-type products is experiencing a rapid and notable enhancement. Industry frontrunners like Trina Solar, JA, Risen Energy, and Tongwei have strategically established N-type production bases. Remarkably, some of these enterprises have already achieved the crucial milestone of mass production and shipment, and are expected to achieve the imminent breakthrough of N-type products. N-type products have assumed a pivotal role in the photovoltaic industry’s imperative to curtail costs while elevating efficiency. Moreover, it seamlessly aligns with the trajectory of the sizable 210mm technology route. Recent headlines showcase Trina Solar’s remarkable progress, achieving the mass production of the groundbreaking Supreme N-type 700W+ module. This achievement is grounded in the utilization of the new generation N i-TOPCon advanced technology, as well as the robust support of the advanced 210 product technology platform. Notably, this milestone ushers in an era where the power output surpasses the 700W threshold. Trina Solar's ambitions extend even further, with the pre-release of their 2024 upgrade products. This foresight underscores their commitment to innovation and progress. In 2024, Supreme N modules are set to undergo a series of enhancements, leading to the mass production of upgraded variants boasting impressive power outputs of 620W and 710W.

Beyond its role in pioneering cost-effective and efficient solutions for the industry, the mass production of Trina Solar’s 210+N module products signifies a significant stride towards the heightened industrialization of its technological trajectory. This substantial advancement serves as a beacon propelling the photovoltaic industry into the realm of high-efficiency power outputs exceeding 700W. The N-Type market is poised to experience a rapid and explosive surge in the near future. As outlined in Trina Solar’s first-half 2023 report, their proactive approach remains steadfast. The company is unwavering in its commitment to expanding the N-type industrial chain's footprint. By the conclusion of 2023, Trina Solar is on track to possess an impressive N-type wafer production capacity of 50GW, complemented by a cell production capacity of 75GW, with a substantial 40GW dedicated to N-type cells.

Nine module companies have aligned in agreement to standardize module sizes, heralding a transformative shift toward the 210R as the new vanguard for efficiency enhancement.

The prior complexity stemming from varying rectangular wafer module sizes had long impeded the industry’s advancement. Consequently, the call for standardization had been brewing for quite some time. In July 2023, representatives from an esteemed cohort of module manufacturers—including Canadian Solar, Risen Energy, JA, JinkoSolar, LONGi, Trina Solar, Tongwei, Das Solar, and Astronergy—united to forge a consensus regarding the dimensions of the new-generation rectangular wafers, specifically the type measuring 238mm x 1134mm.

Analysis on size and power of the large, medium and small modules among major module enterprises (mainstream products only)

This landmark development is accompanied by a significant drive for enhanced efficiency through not only high-efficiency cell technologies like N-type, but also the embrace of rectangular wafers. In April 2022, Trina Solar emerged as a trailblazer, unveiling the 210R series to industry acclaim. By March 2023, Trina Solar had unveiled comprehensive 210R product solutions, along with the clear roadmap towards industrialization, effectively guiding the sector. Moreover, it initiated a crusade for the harmonization of module sizes for cells and wafers, thereby unlocking the industry's latent potential to the fullest extent. This harmonization of rectangular wafer module sizes delivers multifaceted benefits. It curbs material wastage and circumvents the logistical challenges associated with long-distance transportation and application complexities. Furthermore, it maximizes container usage, thereby reducing system costs and optimizing the value of applications for customers.

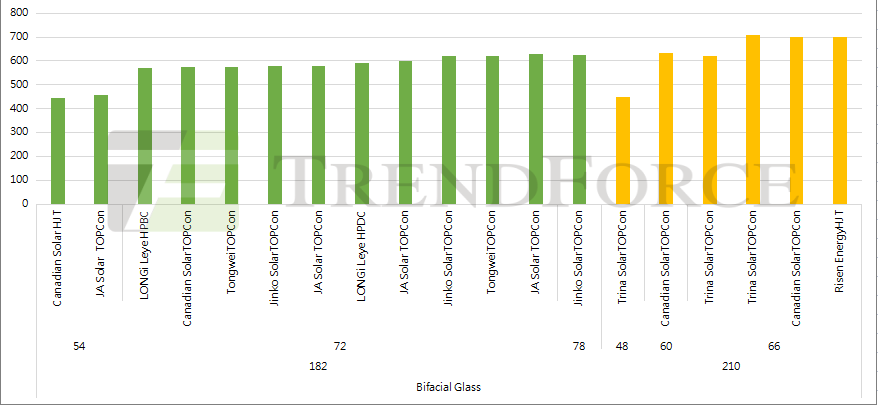

N-type Bifacial glass module versions and power outputs among Leading Module Enterprises (Unit: W)

With the rapid advancement of new energy technologies, the demand within the PV market has experienced a remarkable surge. When it comes to modules, the HJT technology predominantly aligns with the 210mm size, while TOPCon technology finds its niche in both 210 (R) and 19X sizes. However, the power of the 210 module (210R) + N module pairing markedly outshines that of the 19X + N module configurations. Moreover, the industry-standard 210R module size of 2382 * 1134mm has garnered widespread adoption among prominent players like Trina Solar, Jinko Solar, and JA. These leading enterprises have strategically chosen this size, allowing ample time for mass production and order fulfillment. Among them, Trina Solar has accomplished the mass production and shipments within the first half of this year. Meanwhile, JA is poised to enter the arena of significant sales volumes starting from the third quarter of 2023. Additionally, Jinko Solar has prepared to commence the sale of rectangular module products, a step slated to begin in 2024.

Furthermore, Trina Solar is gearing up to unveil its enhanced product in 2024, featuring an impressive power output of 710W for the large-size module variant and 620W for the medium version. The era of N-type modules, particularly the 210mm variant, stands out for its remarkable compatibility. However, this compatibility is only a fraction of the story. Leveraging the distinctive advantages of rectangular wafers introduces an avenue for yet another breakthrough in module power. This innovation underscores the extensive room available for ongoing technological enhancement. The prospects within the realm of 210+ N-type products extend beyond mere innovation. This pioneering technology reverberates throughout the entire industrial chain and resonates within the customer market, ultimately catalyzing the photovoltaic industry’s journey towards high-quality development.