A retrospect on the global PV market of 2021 indicates that installation demand was not fully released due to the pandemic development in overseas and the higher prices of the PV industry chain. According to the analysis of EnergyTrend under TrendForce, the release of expanded polysilicon capacity and the fallback of prices in various segments of the industry chain under the vigorous development of renewable energy and Europe’s exacerbated energy crisis is expected to generate a YoY growth of 41.18% in new PV installations throughout 2022, arriving at 240GW that is roughly 9% higher than the previous projection at 220GW.

Installation Demand Forecast for Global GW-Grade PV Markets in 2022 (Unit: MW)

* Arrows pointing up represent upward adjusted installation demand, and vice versa.

Source: TrendForce

1. Asia-Pacific: China, India, Australia to See Major Increment

China: New Installations Expected to Arrive at 85GW in 2022

China added 16.88GW of new installations between January and April 2022 under a YoY increase of 138%, of which demand for distributed residential PV had carried on with its high-speed growth, and centralized projects are now abundant in reserves. Central and state-owned enterprises have been active in tenders by having announced nearly 90GW of PV module tenders for 2022 as of now. The 14th Five-Year Plan, guaranteed wind power and PV projects, and large wind power and PV bases are progressing in orderly fashion. 2022 is expected to see 85GW of new installations, which is 13% more than the previous forecast at 75GW.

India: Renewable Energy Target to Yield 16GW of Installations in 2022

India added 5.99GW of new installations between January and April 2022 under a YoY growth of 97.3%, and had 72.61GW of renewable energy projects at various development phases as of the end of February, of which 44.27GW belong to PV projects. According to the statistics of the Ministry of Commerce and Industry, the country started imposing a respective BCD of 25% and 40% on imported cells and modules since April 1st 2022, and imported US$1.23 billion of PV cells and modules during the first quarter of 2022 under a YoY surge of 374%. India proposed the target of carbon neutrality by 2070 at the 2021 UN Climate Change Conference, while the PLI scheme will also stimulate PV installation demand for the country that is expected to arrive at 16GW in 2022.

Australia: Green Hydrogen and Energy Storage to Impel Growth in PV Installations

Australia added 4.61GW of new PV installations throughout 2021 primarily on rooftop PV, and has accumulated 25.3GW of installations. The advanced green hydrogen program will facilitate a continuous and expeditious growth in wind and solar power for Australia. In addition, each state has been actively proposing policies that would stimulate development for energy storage systems, including subsidization and interest-free loans. Green hydrogen and energy storage will yield growths in PV installations.

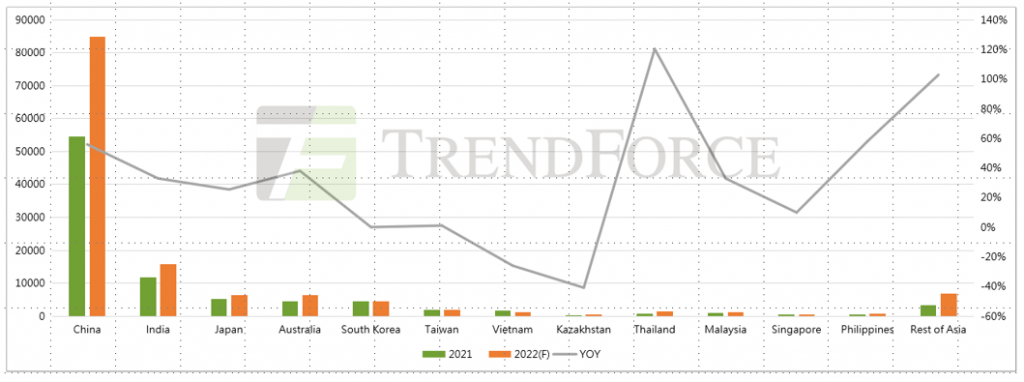

New PV Installation Demand Forecast for Asia-Pacific in 2022 (Unit: MW)

Source: TrendForce

2. Europe: PV Installation Demand to Arrive at 49.08GW in 2022 under Policy Support and Raised Targets

The Russia-Ukraine conflict has accelerated the development of renewable energy. In order to completely extricate from the dependency on Russia’s natural gas provision, various European countries are currently improving their capability of generating power through renewable energy. The REPowerEU plan specifies that the EU will climb from 40% to 45% in the ratio of renewable energy by 2030, and double in PV power generation compared to the current period then, with the accumulated installations arriving at 740GW that is roughly 70GW more than the original plan.

Germany: Upward Adjusted Renewable Energy Target to Stimulate PV Installations

The Federal Minister for Economic Affairs and Climate Action proposed a series of energy measures, and had upward adjusted the ratio of power generation through renewable energy, as well as presented the target that comprises of an increase in accumulated PV installations to 215GW (previously at 200GW) by 2030 and an arrival at 22GW (previously being 20GW by 2028) in new installations by 2026. As a result, an explosive phase for PV development will be seen in the country throughout the next five years. Germany is planning for three tender rounds in 2022, including ground power station and rooftop PV projects, at a total capacity of 5.9GW. The country is expected to attain 7.6GW of new PV installations in 2022, which is higher than the previous anticipation.

Spain: Non-Subsidized Projects Expected to Welcome Rapid Development

Spain added 489MW of PV installations during 2022Q1 and has now accumulated more than 15GW of installed capacity. The country has achieved parity for the power generation end, and the PV market is primarily driven by government’s tender projects and non-subsidized PPA projects. Spain planned to initiate the third round renewable energy tender in April 2022, which included 140MW of distributed PV projects. Spain is expected to arrive at 7.55GW of new PV installations in 2022.

Netherlands/Poland: Distributed PV Development Likely To Continue in Robustness from the Support of Policies

The Netherlands remains stable in market share for the rooftop PV market, and has seen a marginal reduction in other PV projects. Dutch transmission system operator Tennet estimates that the country is likely to attain 34GW of accumulated PV installations by 2030. The Netherlands plans to initiate a new round of the SDE++ subsidization on June 28th 2022 at a budget of EU€13 billion, which is the largest sum ever. Poland added most installed capacity in 2021 from distributed projects, and favorable policies such as net-metered electricity tariffs have facilitated robust development for the country’s distributed PV market.

PV Installation Demand Forecast for Various European Countries in 2022 (Unit: MW)

Source: TrendForce

3. America: US, Brazil, and Chile Occupy Top Three Major Markets

US: Imported Modules are Exempted from New Duties for Two Years

The US has announced that imported modules would be exempted from new duties for two years in accordance with the previous anti-circumvention investigation on the four Southeast Asian countries. The anti-circumvention investigation has severely damaged the country’s renewable energy development, and led to incessant constraints in supply chain, as well as rising electricity tariffs and repeated challenges in power grids, where multiple projects have now been postponed from 2022 to 2023 or even later regarding grid-connection. Although new policies are favoring local market development, the increasingly intensifying issue surrounding the import ban on Xinjiang-made products is expected to result in merely 26GW of new PV installations for the US during 2022, which remains below the previous anticipation.

Brazil: New Net Metering Regulation Continues to Favor Distributed PV Projects

Brazil relies on hydroelectricity for 2/3 of its power supply. The country, having seen a rise in electricity tariffs in the most recent two years due to water scarcity, is now accelerating the development of wind power and PV, of which distributed PV is experiencing a rapid and aggressive advancement. Brazil has updated its net metering regulation, and continues to elevate distributed PV projects by offering tax preferences. For the tender end, the country had convened 10 PV project auctions as of the end of 2021 at a total of 4.9GW. It is estimated that there are still approximately 1.27GW of auctioning projects that are under construction. In addition, non-subsidized PV projects are also experiencing a brisk progress.

Chile: More Reserve Projects and Larger Room for Development

PV occupies a leading position in Chile’s renewable energy installations, with more projects awaiting for construction. The country had accumulated 5GW of PV installations as of March 2022, while 3.4GW of PV projects are currently under construction. 30.24GW of PV projects have now passed EIA, with 5.79GW of projects that are still at the eligibility review phase.

New PV Installation Demand Forecast for America (Unit: MW)

Source: TrendForce

4. Middle East & Africa: Excellent Insolation Resources and Support from Policies to Provide Sufficient Momentum for PV Development

UAE: Green Hydrogen and Energy Strategies to Propel Development in PV Projects

UAE’s PV installations are primarily centralized in Abu Dhabi and Dubai, and the two areas have started constructing large PV projects under the UAE’s National Energy Strategy 2050. The green hydrogen market, with significant potential, is becoming one of the development focuses for UAE’s new energy strategy.

Saudi Arabia:

Saudi Arabia’s PV development is mainly driven by public utilities, and has yet to exert its potential. According to Vision 2030, the country is expected to arrive at 60GW of renewable energy capacity by 2030, of which PV would account for 40GW. Saudi Arabia had installed less than 500MW of renewable energy as of the end of 2021, which is a sizable difference compared to its target, and failed to exert its PV market potential. The country is expected to attain 1.5GW of PV installations throughout 2022.

South Africa: Prioritizes on PV Development amidst Severe Power Scarcity

The PV market of South Africa serves as a leader in the African market, where new PV installations are also experiencing a faster growth, though the surge of supply chain prices, coupling with the severe power shortages of the country, had resulted in worse-than-expected new PV installations in 2021 at merely 23MW. South Africa is expected to welcome an explosive growth in PV installations to 1.6GW during 2022. It is noteworthy that issues pertaining to the inflation of supply chain, power scarcity, and financial settlement for PV projects may postpone the country’s development progress in renewable energy.

New PV Installation Demand Forecast for Middle East & Africa (Unit: MW)

Source: TrendForce

Comprehensively speaking, TrendForce believes that the demand end of the global PV market can focus on the three following aspects for 2022:

1. Global PV installation demand will arrive at 240GW in 2022 under a YoY increase of 41%. Installation demand has yet to fully release after having gone through the impact from the pandemic and the obstinately high supply chain prices in 2021. 2022 demand is expected to amplify drastically, with global installations arriving at 240GW that would shoulder the responsibilities in tackling the global energy crisis and environmental protection.

2. Installation demand is differentiated in multiple regions, with exponential growth likely to be seen in Europe. Asia, India, and Vietnam are holding onto a large volume of constructing projects, and would welcome a peak of centralized grid-connection within the next three years. Matured markets such as Japan, South Korea, and Australia are gradually stabilizing in annual demand. In terms of Europe, the Russia-Ukraine conflict has exacerbated the region’s energy crisis, where Germany, France, and the UK are proposing corresponding policies to elevate targets of energy development, as well as increase tender capacity for PV and wind power projects, with a thriving degree of market demand that is expected to persist throughout 2022 and may further ascend subsequently. Regarding America, the US, Brazil, and Chile are occupying the top three markets, while Colombia and Canada are expected to explode in demand. Lastly, for Middle East and Africa, solar projects in UAE and Saudi Arabia are expediting in development from the propulsion of renewable energy targets thanks to the optimal climate and insolation resources.

3. Factors surrounding exorbitant supply chain prices, load challenges for power grids, and the impact from the pandemic must still be accounted for. The current high prices from the PV industry chain due to the confinement by market supply and demand is prompting a number of projects to gradually suspend due to deteriorating rate of return, while the steadily accelerating speed in new PV installations may impose enormous challenges for power grids. In addition, the impact from the pandemic should not be ignored as it can result in worse-than-expected release of installation demand for partial regional markets.

The content and statistics from this article are sourced from TrendForce’s Global PV Market Demand report. Please contact the following windows if you would like to know more details regarding the report.

Gino Tang

+ 86-150-1369-8112

Ginotang@trendforce.cn

Eric Chang

+886-2-8978-6488 ext.822

Eric.chang@trendforce.com